Do You Have Questions About Dutch Mortgage Repayment Schedules?

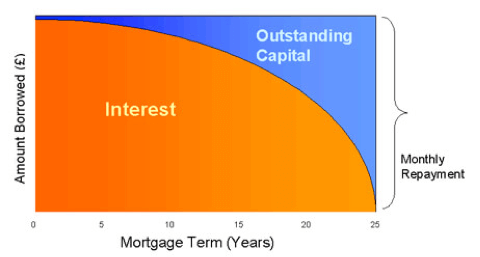

With an annuity (capital repayment) mortgage, you are sure that your mortgage will be paid off at the end of the mortgage. Your (gross) monthly amount will not change during the fixed interest period. By this you will avoid fluctuations in your monthly Dutch mortgage repayment schedule.

The monthly amount you pay consists of interest and principal. At the beginning of the mortgage, your payments consist of a small amount of principal, while the interest component is relatively high. The advantage is that you profit from a higher tax deduction for the interest paid at the beginning of your mortgage. At the end of the mortgage, you repay a higher amount of principal, while paying less interest. Due to the decreasing interest payments, your tax returns will also decrease over the term of the mortgage and your tax burden will go up.

Why choose this repayment schedule?

- With an Annuity mortgage, you know exactly what your monthly payments are.

- Your gross monthly payments remain unchanged during the fixed interest period

- In the beginning you pay a small amount of principal and profit from a higher tax return for the interest paid.

- The mortgage will completely pay off at the end of the term.

- Do you want to learn more about the tax implications and your repayment click the image

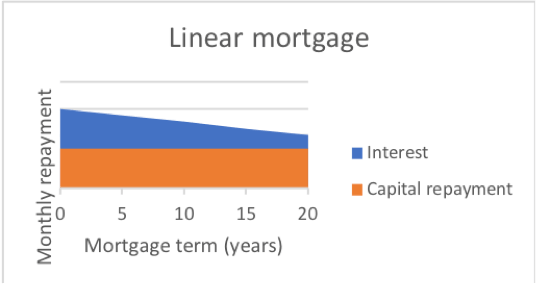

With a linear mortgage, you pay off the full mortgage just like the annuity. The big difference compared to the annuity is that the linear mortgage has a fixed principal which has the interest payment of the remaining loan on top of the principals.

The monthly installments will decrease on a monthly basis because the bank will charge you only the interest over the remaining loan which is paid off every month more. The initial monthly payments will be higher than an annuity mortgage in the beginning because of the fixed principle.

Why choose this repayment schedule?

- With a Linear mortgage, you start repaying your loan quicker

- Overall you will pay less interest compared to an annuity

- In the beginning, you pay a higher installment at the end you will pay a lower installment

- The mortgage will completely pay off at the end of the term.

- Do you want to learn more about the tax implications and your repayment click the image

Contact us today

Please fill out the form and we will get back to you as soon as possible.

WhatsApp us

WhatsApp us